-

TOP

- Sustainability

- Governance

- Corporate Governance

Corporate Governance

Basic Policy

YAMAZEN’s management places the highest importance on the issue of elevating fairness and transparency in corporate management, as well as on maintaining and improving the corporate management structure to ensure that it is capable of providing appropriate responses to changing business environments in a timely manner. Determined to become a corporate entity that is trusted, supported, and looked favorably on by a broad spectrum of society, YAMAZEN and its group companies have established Sustainability Management Meeting and various committees, formulated the “Charter for the Corporate Behavior of the Yamazen Group,” and built a corporate governance structure so as to not only ensure risk control and legal compliance but also to enhance the trust of all stakeholders, such as shareholders, and for sustainable growth and the enhancement of corporate value.

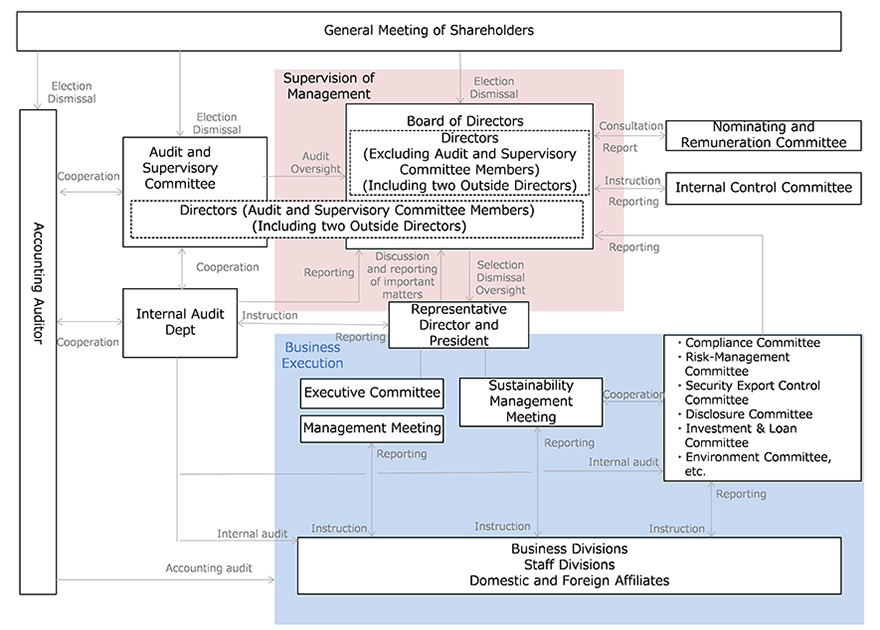

Overview of Corporate Governance Structure

With the aim of strengthening Board of Directors functions for supervising management and of speeding up decision-making, the Company has adopted a company with an Audit and Supervisory Committee, whereby an Audit and Supervisory Committee consisting of three Directors who are Audit and Supervisory Committee Members (including two who are Outside Directors) works to audit and supervise the execution of duties by the Board of Directors.

[Board of Directors]

The Board of Directors meets on a monthly basis in order to make decisions on important management matters, and supervise the execution of business. In order to ensure the effectiveness of the Board of Directors supervisory function, as a rule, independent outside Directors make up one-third of the Directors of the Company. The number of Directors in the Corporate Governance Report submitted on June 30, 2025 (including Directors who are Audit and Supervisory Committee Members) was 9, of which four were outside Directors, with two of these four being Audit and Supervisory Committee Members.

Furthermore, pursuant to the provisions of item 6, Paragraph 13 of Article 399 of the Companies Act, the Board of Directors has delegated certain important matters of business execution to the Representative Director and President, conditional on a decision being obtained from an Executive Committee composed of the all Representative Directors and Corporate Officers. With the aim of enhancing deliberations of highly important items by the Board of Directors and strengthening its supervisory functions, in other matters the Company seeks to speed up decision-making by the Representative Director and President. Comprehensive reports on matters determined by the Executive Committee are submitted to the Board of Directors, thus ensuring that outside Directors and Audit and Supervisory Committee Members exercise their audit and functions.

[Audit and Supervisory Committee]

Through attendance at the monthly meetings of the Board of Directors and its own audit activities, the Audit and Supervisory Committee audits and supervises the legality of execution of duties by Directors, as well as the reasonableness and appropriateness of its decisionmaking and management judgments.

[Nominating and Remuneration Committee]

The Nominating and Remuneration Committee deliberates on matters related to the nominating and remuneration of Directors and others, and submits reports to the Board of Directors. The Committee consists of at least three Directors, selected by a resolution of the Board of Directors, of whom a majority are independent outside Directors. The chairperson of the Committee is selected by a resolution of the Committee from among those Committee members who are independent outside Directors. Note that this is not a legally mandated Committee.

[Accounting Auditor]

The Company has appointed Deloitte Touche Tohmatsu LLC to perform accounting auditor audits pursuant to the provisions of the Companies Act, audits of the financial statements pursuant to the provisions of the Financial Instruments and Exchange Act, audits of the internal control system, and quarterly review services.

[System for the Execution of Business]

By separating roles and responsibilities into supervision of management (monitoring) and execution of business (management) in order to enhance the flexibility of management, the Company has introduced a Corporate Officer system. With the aim of strengthening “earnings capabilities” and “productivity,” the Company has also introduced an officer structure as its unique system for senior management.

(Overview of Corporate Officer and Officer Structure)

Corporate Officers:managers nominated by the Board of Directors and tasked with executing the core business of the Company, who serve for a period of one year. They mainly execute the core business for which they are responsible, but as members of the Executive Committee they have a responsibility for the overall management of the Company that transcends the duties of which they are in charge.

Officers:managers nominated by the Executive Committee as individuals with a high level of insight or expertise in specific geographical areas or specialist fields, who serve for a period of one year. Together with the Corporate Officers, they form the Management Meeting, and have responsibility for executing the duties of which they are in charge. As of June 30, 2025, the number of Corporate Officers was 13 (including four serving concurrently as Directors), and the number of Officers was 15.

[Executive Committee]

In accordance with the management policy and management objectives, etc. of the Company, this body deliberates and determines basic and important matters relating to the execution of the Company’s business, and is attended by the Representative Directors and Corporate Officers.

[Sustainability Management Meeting]

This body evaluates various risks and opportunities related to the Company’s priority issues (materiality), formulates action plans, verifies initiatives of each business division across the Group, deliberates on matters concerning approval and information disclosure, and is attended by the Representative Directors and Corporate Officers.

[Management Meeting]

This is held on a monthly basis as a body for the submission of reports related to execution of business, exchanging information, and other activities, and is attended by Representative Directors, Corporate Officers, Officers, and Full-time Audit and Supervisory Committee Members.

Governance Structure

Last updated June 30th, 2025

Skill Matrix

| Position | Name | Skills (Knowledge, Experience, Capabilities, Etc.) | ||||||

|---|---|---|---|---|---|---|---|---|

| General Management |

Sales and Marketing |

Global | Finance and Accounting |

Legal and Risk Management |

Personnel and Human Resource Development |

ESG and Sustainability |

||

| Representative Director, President & CEO |

Koji Kishida | ✓ | ✓ | ✓ | ✓ | |||

| Representative Director | Kimihisa Sasaki | ✓ | ✓ | ✓ | ||||

| Director | Masamichi Yamazoe | ✓ | ✓ | ✓ | ✓ | ✓ | ||

| Director | Naonori Nakayama | ✓ | ✓ | ✓ | ||||

| Outside Director | Hirohiko Sumida | ✓ | ✓ | ✓ | ||||

| Outside Director | Atsumi Eguchi | ✓ | ✓ | |||||

| Director Full-time Audit and Supervisory Committee Member |

Shinichi Kiyohara | ✓ | ✓ | ✓ | ||||

| Outside Director Audit and Supervisory Committee Member |

Yoshinori Tsuda | ✓ | ✓ | |||||

| Outside Director Audit and Supervisory Committee Member |

Naoko Nakatsukasa | ✓ | ✓ | |||||

Corporate Governance Functions and Roles Fulfilled by Outside Directors

The Company has appointed four outside Directors.

These include two Directors who are Audit and Supervisory Committee Members.

Reason for appointment

Hirohiko SUMIDA

Hirohiko SUMIDA possesses keen insight and abundant experience gained through his service as a representative director and president at another company, in addition to which he has wide-ranging insights into IT. The Company judges that his pertinent advice on matters concerning the overall management of the Company will improve the effectiveness of the decision-making and supervisory functions of the Board of Directors, and further enhance the corporate governance of the Group.

Atsumi EGUCHI

Atsumi EGUCHI possesses abundant experience and broad insight, including being involved in R&D and public relations departments of a beverage and food manufacturer, as well as leading the implementation of strategic plans and overall CSR activities in a corporate communications department. The Company determines that it can be expected that her pertinent and independent advice on matters concerning the overall management at Board of Directors meetings of the Company from the perspective of corporate communications and diversity will improve the effectiveness of the decision-making and supervisory functions of the Board of Directors, and further enhance corporate governance for the Group.

Yoshinori TSUDA

Yoshinori TSUDA possesses expertise and professional ethics formed as a certified public accountant, and a wealth of experience as an outside auditor at other companies. Based on this, he provides suitable advice on ensuring the appropriateness of financial statements and auditing in general.

Naoko NAKATSUKASA

Naoko NAKATSUKASA possesses expertise and professional ethics form as an attorney-at-law and a wealth of experience as an outside director and outside auditor at other companies. Based on this, she provides valuable advice and appropriate audits and supervision in deliberations on proposals at meetings of the Board of Directors.

Details of criteria and policy relating to independence from the Company when appointing outside Directors

During the selection process, a pool of candidates whose independence can be ensured is created with reference to various regulations concerning independence, such as the regulations, etc. of the Tokyo Stock Exchange. After comprehensive consideration of each person’s experience, expertise, character, insight, and other attributes, individuals are selected based on their ability to speak and act appropriately in ways that enhance functions for the supervision and oversight of the Company’s management.

Cooperation between supervision or audits by outside Directors and internal audits, audits by the Audit and Supervisory Committee and accounting audits, and relationship with internal control departments

Outside Directors who are Audit and Supervisory Committee Members receive advance explanations, at the Audit and Supervisory Committee, of Board of Directors resolutions and important matters reported to the Board of Directors, as well as receiving reports on the content of the Management Meeting and other important meetings attended by Full-time Audit and Supervisory Committee Members, and conduct audit and supervisory functions by exchanging information and opinions with Accounting Auditors and the Internal Audit Department.

In order to ensure correct statements and behavior, the Company has also designated the Corporate Planning Department as the contact point for the appropriate and timely exchange of information, which is carried out after outside Directors have fully understood resolutions by the Board of Directors and reports of important matters. Moreover, the Company provides detailed explanations in advance of Board of Directors resolutions and reported matters, as well as enabling cooperation with relevant departments, as necessary. Furthermore, the Audit and Supervisory Committee cooperates as appropriate with the Corporate Administration H.Q. to enhance the effectiveness of audit and supervisory functions.

Initiatives to Enhance the Effectiveness of the Board Of Directors

Overview of initiatives

- As a means of enhancing the effectiveness of the Board of Directors, the Company has implemented an annual questionnaire survey of the effectiveness of the Board of Directors, and conducts an analysis and evaluation of the results. In addition, priority issues are determined based on the results of the questionnaire survey, and countermeasures are formulated and implemented with the aim of improving the effectiveness of the Board of Directors. The Board of Directors plans to continue to implement self-assessments of members going forward in order to enhance its functions.

Evaluation results

-

A questionnaire survey on the effectiveness of the Board of Directors in FY2023 was conducted in March 2024 with the assistance of an external agency to enhance transparency. The main questions were as follows:

• Functions and roles of the Board of Directors; composition and scale of the Board of Directors; operation of the Board of Directors; collaboration with auditing bodies; communication with management team; and relationships with shareholders and investors - Based on analysis of the results of the questionnaire survey and related deliberations by the Board of Directors, the effectiveness of the Board of Directors was analyzed. It was deemed to be fulfilling its roles and meeting expectations appropriately, and to be ensuring its own effectiveness.

-

Additionally, based on the results of the questionnaire survey, we have identified the following priority issues for future action and are formulating and implementing countermeasures.

• Exchange of opinions concerning medium- to long-term management strategies that will contribute to sustainable growth and the enhancement of corporate value

• Consideration of training policies for officers

• Promoting dialogue with shareholders, institutional investors, and individual investors, and enhancing approaches to information disclosure

Status of measures to address issues recognized in the previous fiscal year

- In response to issues recognized in previous questionnaire surveys on the effectiveness of the Board of Directors, we have implemented the following measures with the aim of improving effectiveness.

| Issues Recognized | Measures |

|---|---|

| Approach to shareholders (including institutional and individual investors) and dissemination of information | Issued integrated reports, and held informational briefings and one-on-one meetings between the CFO and institutional investors as appropriate |

| Holding meetings to exchange opinions on medium- to long-term management strategies that contribute to sustainable growth and increased corporate value | Held three annual discussion sessions on mid- to long-term management strategies, including business portfolio, human resources investment, and growth investment |

| Securing sufficient time for prior review of Board of Directors meeting agendas | Thorough pre-distribution of Board of Directors agenda materials (aiming for three business days in advance) |

Basic Policy on Remuneration For Directors and Other Officers

Based on the Company having designated further increases in corporate value as an important management issue, and its belief that further improvements in corporate value should be sought, the Company’s basic policy on remuneration, etc. for Directors (excluding Directors who are Audit and Supervisory Committee Members; hereinafter the same shall apply), is to maintain a remuneration structure that raises awareness of the need to contribute to increases in corporate value and improve corporate performance not only from a short-term perspective but over the medium to long-term.

Remuneration, etc. for Directors consists of an appropriate combination of a set amount of “fixed remuneration” of fixed amount, and “performance-linked remuneration” in which the amounts paid vary in accordance with performance and other factors. In this way, the Company aims to secure competent personnel, generate an incentive to improve corporate value, and build a remuneration system that works to increase corporate value further.

“Performance-linked remuneration” is not paid to outside Directors.

Remuneration, etc. for Directors of the Company is decided in accordance with the Policy on Determining Director’s Remuneration, etc. and associated procedures, with the Board of Directors taking into account corporate performance, the scale of the business and various other factors during the process of determining the amounts involved.

Composition of Remuneration for Directors and Other Officers

Remuneration, etc. for Directors consists of a “fixed amount “of fixed amount and “performance-linked remuneration” in which the amounts paid vary in accordance with performance and other factors. The proportions of each are based on levels at competitors, etc., and in the event that the reference value for consolidated ordinary profit is fully achieved, “fixed remuneration would be 60-70%” and “performance-linked remuneration 30%-40% (with monetary remuneration accounting for approximately 80% and non-monetary remuneration accounting for approximately 20%).”

[Fixed Remuneration]

“Regular remuneration (monetary remuneration)” consists of “basic remuneration,” “representative remuneration,” “director remuneration,” and “remuneration for duties,” with reference levels for each position set out in the Internal Regulations for Directors. Regular remuneration is paid at a set time every month.

[Performance-linked remuneration]

The Company’s performance-linked remuneration consists of “bonuses (monetary remuneration),” which is short-term incentive remuneration that varies in accordance with corporate performance for each fiscal year and other factors, and “share-based remuneration (non-monetary remuneration),” which is medium to long-term incentive remuneration, such as shares, etc. of the Company paid after retirement from the position of Director.

The indicator used for performance-linked remuneration is “consolidated ordinary profit,” which is used to evaluate the Group earnings power, and enables the contributions of Directors of the Company to the overall management to be measured.

・Bonuses (monetary remuneration)

The amount paid is determined on a number-of-months-payable basis in accordance with “consolidated ordinary profit, etc.” set out in the Internal Regulations for Directors. This remuneration is paid at a time every year.

・Share-based remuneration (non-monetary remuneration)

Under this remuneration system, funds provided by the Company are used to acquire shares of the Company through a trust, with shares of the Company, and money equivalent to shares of the Company converted at the market price, granted through this trust to Directors in accordance with performance-linked bonuses for Directors and other officers and “consolidated ordinary profit, etc.” set out in the Share Benefit Regulations for Directors and other officers.

As a rule, Directors shall receive the Company’s shares, etc. upon retirement.

FY2024 Total amount of remuneration, etc.

| Directors and other officers category |

Total amount of remuneration, etc. (millions of yen) |

Total amount of remuneration, etc. by type(millions of yen) | Number of eligible Directors and other officers |

||

|---|---|---|---|---|---|

| Fixed remuneration | Performance-linked remuneration | ||||

| Regular remuneration (monetary remuneration) |

Bonuses (monetary remuneration) |

Share-based remuneration (non-monetary remuneration) |

|||

| Directors * Excluding Audit and Supervisory Committee Members and outside Directors. |

321 | 252 | 55 | 13 | 5 |

| Directors (Audit and Supervisory Committee Members) * Excluding outside Directors. |

25 | 25 | — | — | 1 |

| Outside Director | 28 | 28 | — | — | 5 |

Current State of the Internal Control Systems and their Basic Policies

YAMAZEN considers internal control and compliance a crucial management issue, especially in today’s business environment, which is underscored by increasing globalization and complexity. To achieve greater fairness and transparency in corporate management, YAMAZEN has established an Internal Control Committee. In addition, based on the belief that active, voluntary, and ongoing CSR activities are indispensable for any corporation that aspires to be a business entity that is trusted, supported, and looked favorably on by a broad spectrum of society, a Compliance Committee has been created to ensure the specific and effective implementation of actions for the full enforcement of and familiarization with this policy.

The current state is as follows.

1. Systems for Ensuring Efficient Performance of Directors' Duties

- Authority exercisable by the directors in the course of performing their duties has been explicitly defined upon taking into account managerial risks and the scope thereof and upon further clarification of the assignment of duties to the directors.

- Pursuant to the provisions of Article 399-13, paragraph 6 of the Companies Act, in order to ensure sufficient deliberation and strengthen the supervisory function of the Board of Directors regarding important matters, as well as accelerate decision making procedures by the representative director, president regarding other matters, the Board of Directors delegates parts of the executions of important operations to the representative director, president on the condition that the decisions by the Executive Committee, which is made up of the representative director and all corporate officers.

- In various committees, these members conduct preliminary deliberations on important conditions, etc. and promote the swift and correct decision making of the Board of Directors.

2. Rules and Systems for Management of Risks Against Losses

- The sharing of functions and responsibilities, operational flows and operational rules (control procedures) with respect to the identification of important risks inherent in the Company and the avoidance and minimization thereof, have been defined and placed in order (documented) in the form of rules and regulations, which are to be followed when performing any important processes.

- For the promotion of CSR activities, the Corporate Planning Department, which provides administrative support for CSR activities, is responsible for comprehensive risk management and the administration of oversight with respect to the execution of risk management. The Internal Control Committee evaluates the effectiveness of CSR activities from an independent point of view, and the Compliance Committee rolls out specific and effective actions designed to mitigate risks and prevent risks from becoming full-fledged issues.

3. Systems for Preservation and Management of Information Related to Directors' Performance

- Systems based on Yamazen's document control rules and other relevant company regulations are in place to ensure the preservation and management of information concerning the execution of the directors' duties, which may be viewed by the directors and at any time.

4. System for reporting to YAMAZEN on matters regarding execution of duties by directors and others of subsidiaries

- YAMAZEN requires subsidiaries to report regularly to YAMAZEN in accordance with the internal rules, concerning the subsidiary’s operating performance, financial position, and other important information.

5. Systems for Ensuring Proper Business Operations within the Yamazen Group

- In an effort to ensure proper business operations at Yamazen's Japanese and overseas affiliate companies, systems will be implemented at respective locations commensurate with their sizes and in conformance with the provisions concerning the seconding of officers, rules governing authority (sharing of authority between Yamazen and its affiliates), business reporting, document storage, internal auditing, risk management and education.

6. Systems for Ensuring Compliance with Laws of Incorporation

- In solemn recognition of the importance of corporate social responsibility, YAMAZEN has embarked on a structure to advance CRS activities. It has also formulated the “Charter for the Corporate Behavior of the Yamazen Group” to ensure compliance, which is an important issue in corporate management.

- For the full enforcement of legal compliance and corporate ethics, every attempt is made by management to voluntarily set a good example and demonstrate good practices to employees to facilitate the penetration of the principles throughout the group. Education and training are also administered to ensure compliance. For employees, the “Charter for the Corporate Behavior of the Yamazen Group” serves as a code of conduct, and YAMAZEN carries out systematic programs to familiarize employees with the charter.

- In an effort to prevent corporate misdemeanors, Yamazen has set up a window within the Company through which company members can report suspicious activities (a system for internal reporting). The system is also designed to ensure the protection of informants with due cause and help corporate ethics take root.

- As in the case of above 2., the Internal Control Committee evaluates the effectiveness of CSR activities from an independent point of view, and the Compliance Committee rolls out specific and effective actions designed to mitigate risks and prevent risks from becoming full-fledged issues.

7. Matters relating to directors and employees who assist in the duties of the Audit and Supervisory Committee

- More than one staff member with a prescribed level of knowledge and experience (“Staff of the Audit and Supervisory Committee”) are assigned to assist in the duties of the Audit and Supervisory Committee.

8. Matters relating to independence of the directors and employees of the previous item from other directors (excluding directors who are audit and supervisory committee members), and matters relating to ensuring the effectiveness of instructions of Audit and Supervisory Committee to such directors and employees

- Matters relating to human-resource management of Staff of the Audit and Supervisory Committee shall require the consent of the Audit and Supervisory Committee.

- The duties of the Staff of the Audit and Supervisory Committee shall be carried out under the direction of the Audit and Supervisory Committee.

9. Systems for Reporting by Directors and Employees to the Audit and Supervisory Committee

- Directors and employees are required to immediately report to the Audit and Supervisory Committee in accordance with the internal rules, if they become aware of an incident that has caused or might cause significant damage to the Company or a violation of any law or of the Articles of Incorporation.

10. System to ensure that the reporting person of preceding item does not receive unfavorable treatment for making such report

- In YAMAZEN’s internal rules, it states that a point of contact that is independent from the management must be established, that the reporting person must remain anonymous, and that any dismissal or other unfavorable treatment for making such report is prohibited.

11. Matters relating to procedures for prepayment or reimbursement of costs arising from the execution of duties of audit and supervisory committee members (limited to matters relating to the execution of duties of the Audit and Supervisory Committee) and policy related to the handling of costs and liabilities arising from the execution of other duties

- YAMAZEN shall promptly handle expenses and liabilities such that have been incurred by an audit and supervisory committee member in executing his or her duties (limited to matters relating to the execution of duties of the Audit and Supervisory Committee; the same applies hereinafter this item), in cases where a request is made to the Company for advance payment of expenses or the like, and whereby, after deliberations at the department or section responsible, except for the case where it is deemed that the expense or liability pertaining to such request is not necessary for the audit and supervisory committee member to execute his or her duties.

12. Systems for Ensuring Effective Auditing by the Audit and Supervisory Committee

- The Audit and Supervisory Committee holds periodic meetings with representative president in an attempt to confirm the management principles of the Company and to exchange opinions regarding challenges that need to be met by the Company, risks surrounding the Company, the state of the auditing environment for audits by the Audit and Supervisory Committee, and significant auditing issues, among others, for better mutual communication.

- The Audit and Supervisory Committee makes efforts to share views and thoughts with the Internal Audit Department and the account auditors to deepen mutual understanding by maintaining an appropriate relationship and coordination with the Internal Audit Department and by holding periodic discussions with the account auditors.

- The Audit and Supervisory Committee may attend Management Meetings and other important meetings, as well as maintain files on meeting minutes, reports, approvals, and other important documents, in order to allow easy and timely browsing only when they deem it necessary.

- Documents whose disclosure is required by law are subject to reporting to and inspection by the Audit and Supervisory Committee in advance of such disclosure.

13. System for ensuring the reliability of financial reports

- To ensure the reliability and appropriateness of financial reports, an internal control system designed for the appropriate and valid filing of internal control reports is in place in conformance with the provisions of the Financial Instruments and Exchange Act. For the operation of the system, an Internal Control Committee has been established. To reasonably ensure the reliability and appropriateness of the system, the committee, in cooperation with the Auditing Department responsible for internal audits, assesses the effectiveness of the system and its operational state.

14. Basic policy toward the elimination of antisocial forces and actions implemented to date

- YAMAZEN’s basic policy calls for a resolute stance when dealing with anti-social forces, which threaten order and safety of civil society and impede sound economic and social development.

- This basic policy has been expressly incorporated into the “Charter for the Corporate Behavior of the Yamazen Group,” which stipulates YAMAZEN’s code of conduct as a basic concept of compliance matters. A companion guidebook has been prepared and distributed to all employees of the YAMAZEN Group for full enforcement.

- As a member of the Osaka Corporate Defense Countermeasures Federation, YAMAZEN receives its guidance and shares pertinent information with the federation.