-

TOP

- Investor Relations

- Initiatives for achieving Our Corporate Vision for 2030

Initiatives for achieving Our Corporate Vision for 2030

Here we present our competitive advantages, business model, business portfolio, capital allocation, and our Corporate Vision for 2030 and strategies.

Competitive Advantages

Yamazen started out as a wholesaler of production equipment, and expanded into the consumer goods business. It has built an extensive network in Japan and overseas, and has supported the sustainable development of supply chains worldwide and contributed to the development of industrial society. Yamazen's people are quick to gather information on the challenges and requests of customers in the supply chain of each business, and use their planning and proposal capabilities to resolve such issues through tenacious negotiations. We will leverage the competitive advantages we have cultivated and the business models we have built to realize our Vision of “Leading worldwide manufacturing and enriched lives.”

1Solid relationships with business partners and significant presence we have built as a wholesaler based on track record in the industry

- Solid relationships with suppliers and buyers we have nurtured for over 70 years

- Global network (16 overseas subsidiaries and 73 business locations in 15 countries/regions as of the end of Dec. 2025)

2Flexible business operations with low risk

- With minimum invested capital, we can change or expand product categories flexibly and approach various markets.

- Promote thorough procurement process based on expected orders

3Human resources who embody our Management Philosophy

- Sales force with the ability to gather information, make proposals, and negotiate tenaciously-embodying our founder's ambition

Yamazen's strengths and appeal from an investor perspective

Director, Executive Officer, and Chief Financial Officer (CFO) Masamichi Yamazoe welcomes Masaki Gotoh, Partner of TriVista Capital Inc., and Fukashi Tsukioka, Senior Analyst of TriVista Capital Inc., to explore our strengths and appeal.

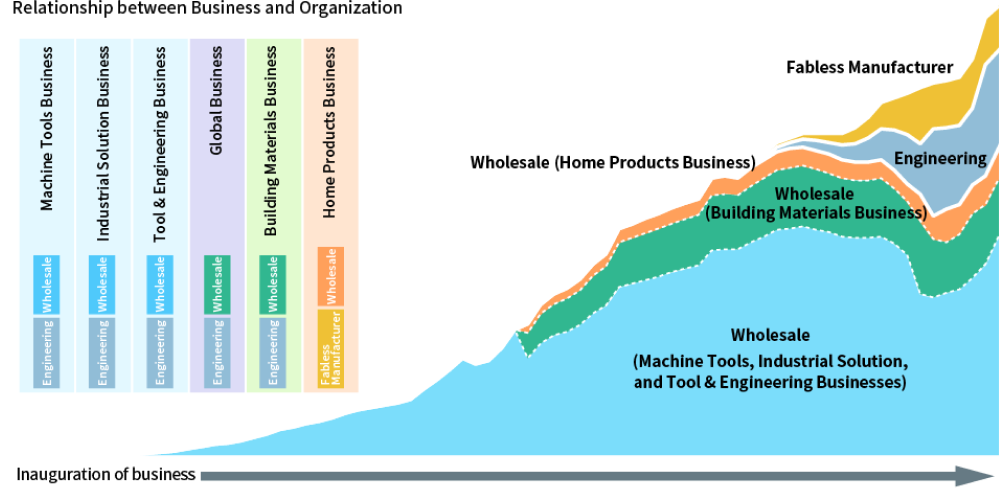

The Three Business Models

Yamazen generates stable, stock-type cash flow through continued transactions with numerous clients in both production and consumer goods via our foundational Wholesale Business. Building on this, we have developed an Engineering Business domestically and internationally and a Fabless Manufacturer Business in consumer goods, steadily increasing both sales and profit. As a result, we now operate based on three business models-wholesale, engineering, and fabless manufacturer-and are expanding each one.

Note: “Fabless manufacturer” refers to net sales of private brand home products and “Wholesale (home products)” refers to net sales of non-private brand products.

Wholesale

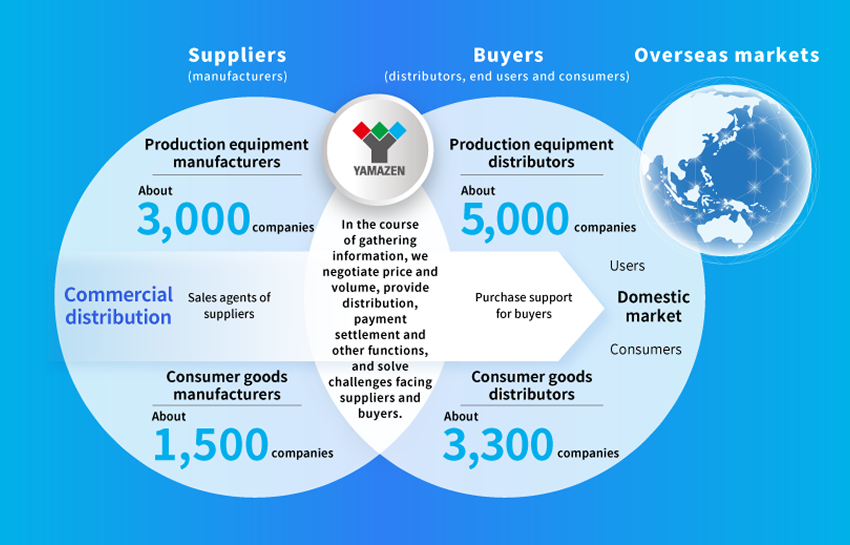

Our core business generates stable cash flow based on trustful relationships with business partners. Solving challenges for both supplier manufacturers by acting as sales agents and for clients by supporting their purchasing needs. Low capital investment and high capital return.

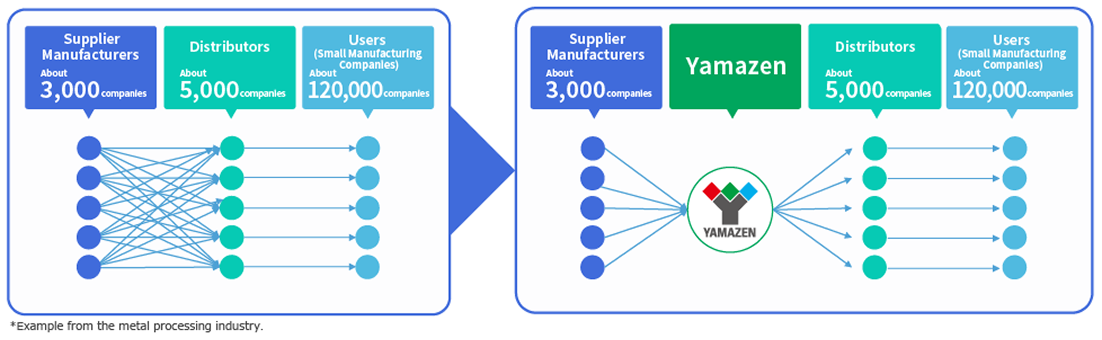

We work with supplier manufacturers, small local distributors, and end-users (small manufacturing companies) in the machine tools industry. Identifying the right equipment among a wide selection of manufacturers and products is challenging for users. At the same time, distributors find it difficult to make optimal proposals based on extensive product information. Similarly, suppliers find it challenging to track which distributors sell their products, and managing individual transactions with distributors can complicate payment collection. Yamazen serves as an intermediary between manufacturers and distributors, leveraging our extensive product knowledge and expertise to propose products that meet user needs. This enables distributors to offer optimal products to users, while supplier manufacturers benefit from a consolidated sales route that reduces the burden of sales operations and payment collection.

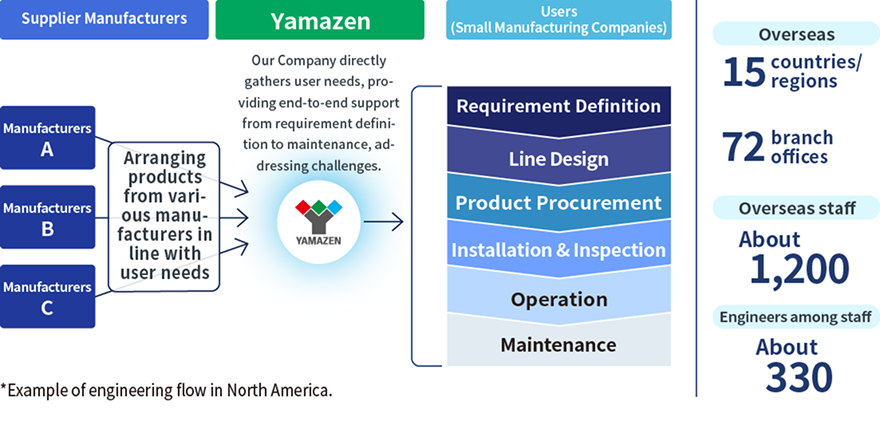

Engineering

Comprehensive support for users' manufacturing processes, including line design and after-sales service, achieved through a localized sales system and advanced engineering capabilities across multiple countries and regions. Expected gross profit secured through value-added proposals.

Engineering refers to a comprehensive support system where our employees directly gather user needs, define requirements, design production lines, procure and install production equipment, ensure operation, and provide maintenance. Overseas, we sell production equipment directly to users without going through distributors. With 73 locations in 15 countries and regions, we employ about 1,200 overseas staff, including roughly 330 engineers who deliver advanced engineering services globally. This business model, priced to reflect its added value, is highly profitable and expected to grow, prompting us to focus on expanding it domestically, especially with large users and new industries.

(production equipment only)

Number of Staff: As of the end of March 2025

Fabless Manufacturer

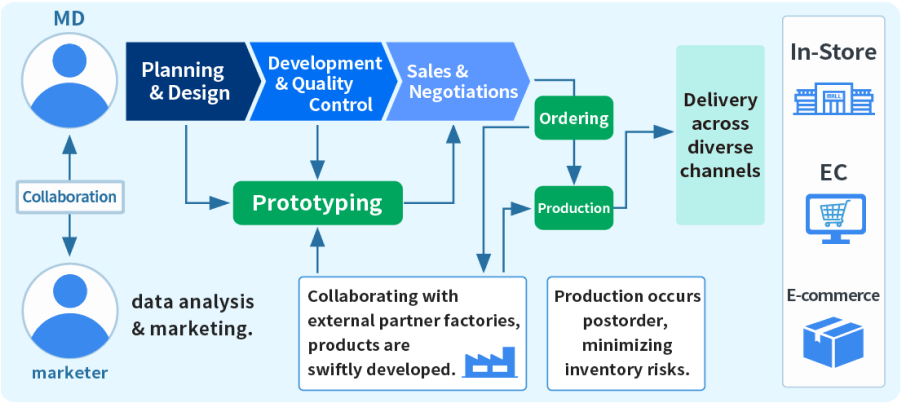

Our MDs (Merchandisers), with extensive sales experience and a deep understanding of consumer and retailer needs, handle planning and development independently and quickly, enabling product commercialization in a short time. High gross profit margins and low risk are due to fabless operations.

Accounting for approximately 60% of sales in the Home Products Business, our MDs analyze consumer needs based on sales data, SNS, and reviews to plan, design, develop, and manage quality. Products are produced in overseas partner factories and delivered to consumers through electronics retailers, mail-order, and online (self-owned and third-party e-commerce platforms). With MDs' experienced insight into consumer and distributor needs and a swift development framework, new products are promptly introduced to the market, minimizing missed opportunities. A high product launch volume per MD is also a defining feature.

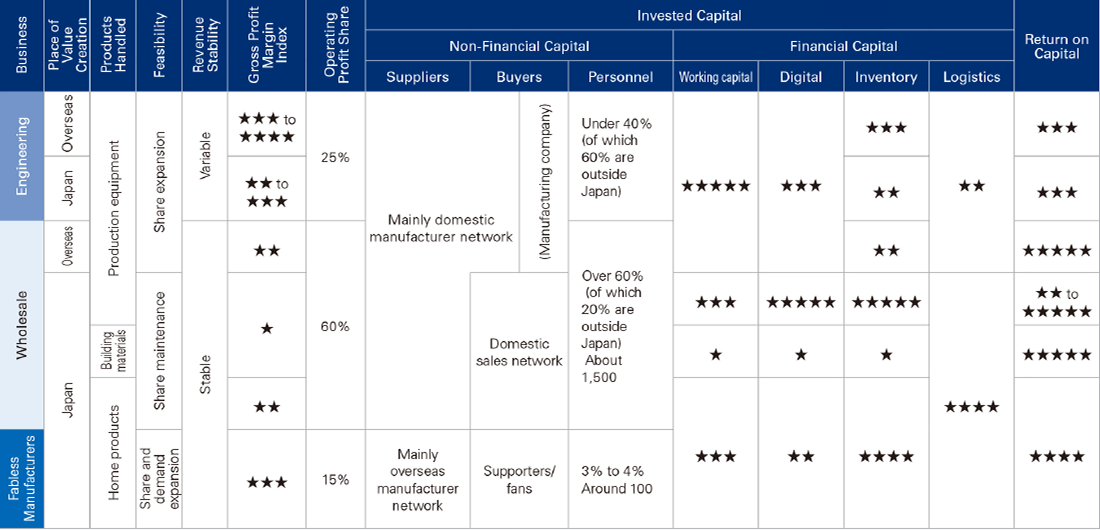

Business Portfolio and Capital Allocation

Positioning human capital as the most important asset and aiming for optimal capital allocation

1Non-financial capital

The key to capital allocation in Yamazen lies in optimal placement and investment in human capital. To ensure sustainable development of the Wholesale Business, we must deepen the relationships we have with our many supplier manufacturers and clients, and cultivating and appropriately placing personnel who can achieve this is crucial. For the sustainable development of the Engineering Business overseas, it is also critical to train or acquire personnel who possess technical expertise and can engage and excel in cross-cultural environments, as this significantly impacts the establishment of a competitive advantage.

2Financial capital

Many of Yamazen's businesses are asset turnover-type businesses, so while expanding our market share, we have pursued improvements in the working capital turnover rate to minimize funding restrictions. As a result, working capital (WC) has been optimized, with some businesses operating with negative WC. Recently, we have actively promoted digital and logistics investments in the Wholesale Business, thereby reallocating human capital-transforming non-financial capital into financial capital-and advancing the acquisition of valuable human capital. Through these efforts, we aim to enhance business sustainability and expand profit by increasing high-quality sales, even if it means sacrificing temporary capital profitability in the Wholesale Business. Our goal is to ensure medium- to long-term capital profitability.

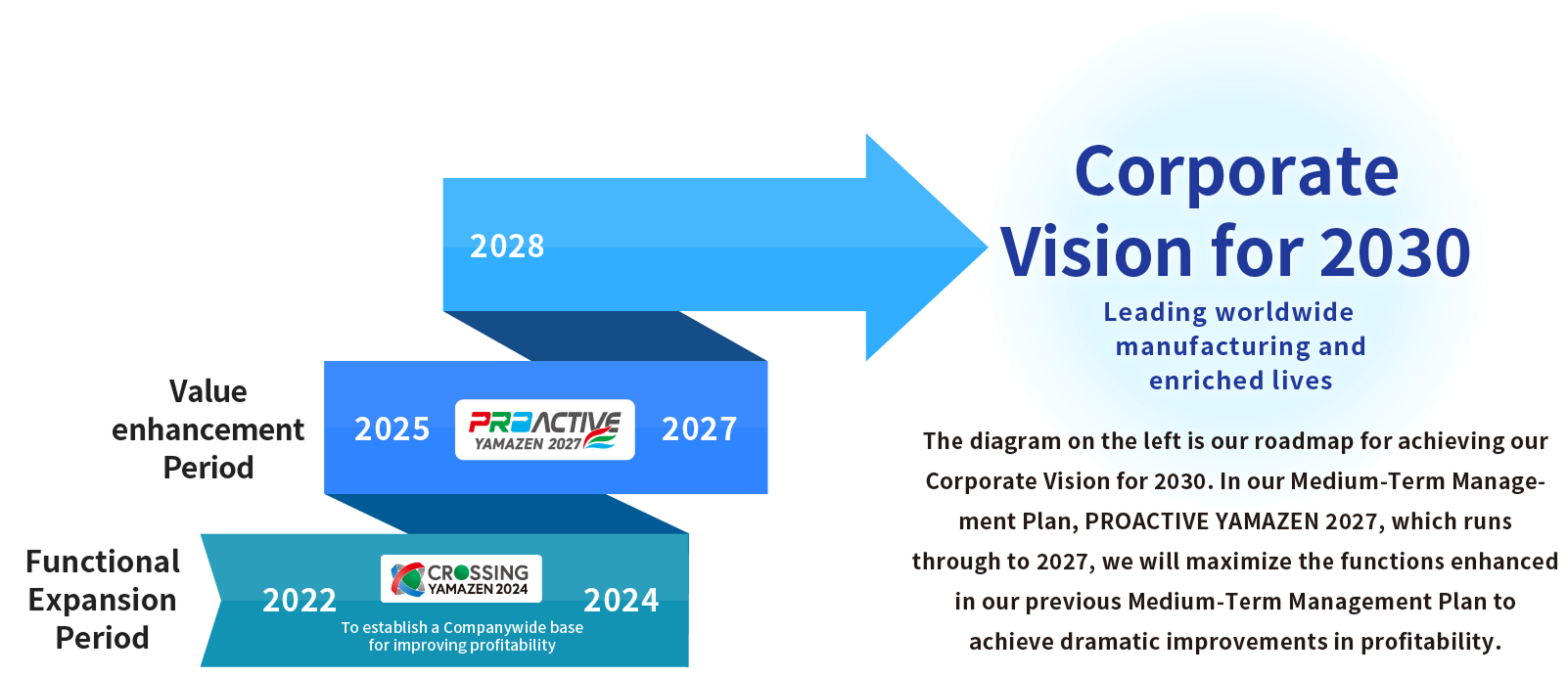

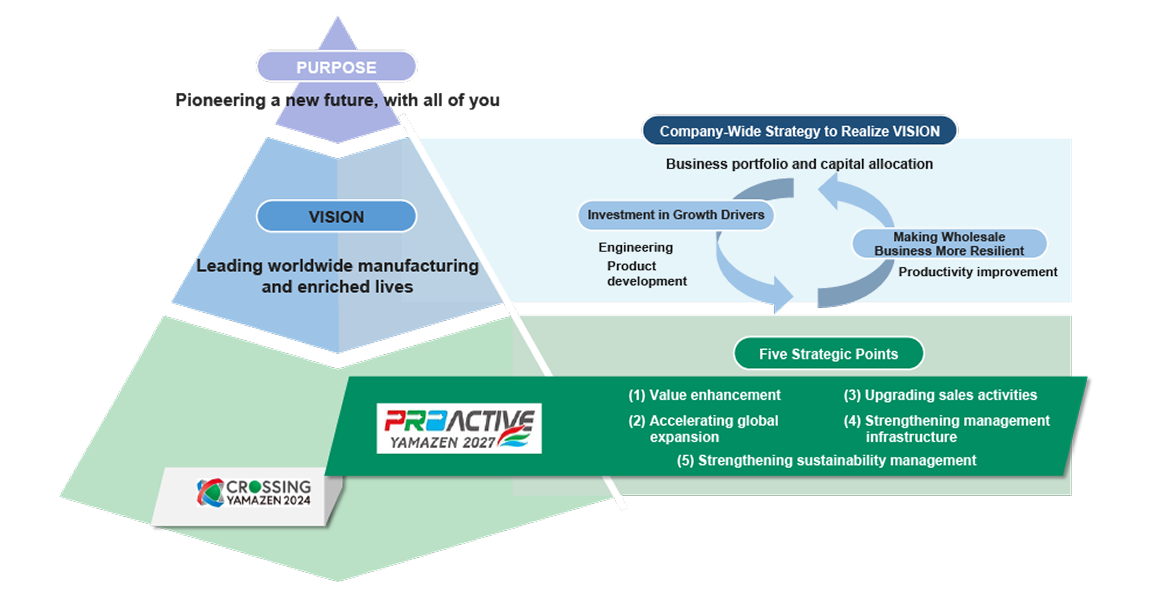

Our Corporate Vision for 2030 and Strategy

Positioning of the Corporate Vision for 2030

Overview of Strategies and Policies to Achieve Our Corporate Vision for 2030

Material Issues for Realizing Our Corporate Vision for 2030

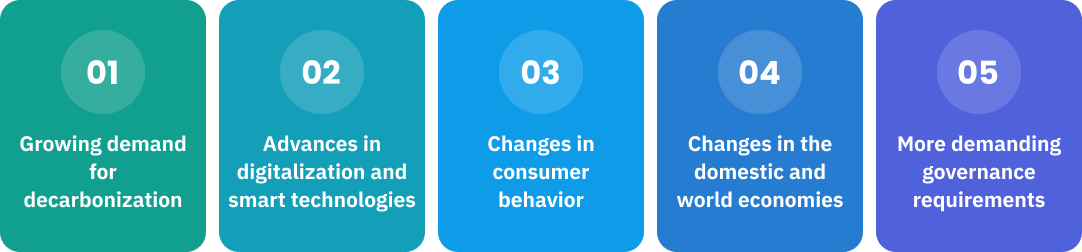

Yamazen and the 2030 World Outlook

Material Issues Derived from Our 2030 World Outlook